Support: Processing Voids

This help article can assist with processing voids in the Support role.

Determining when to void

First thing to check prior to voiding a payroll is what state the pay run is in.

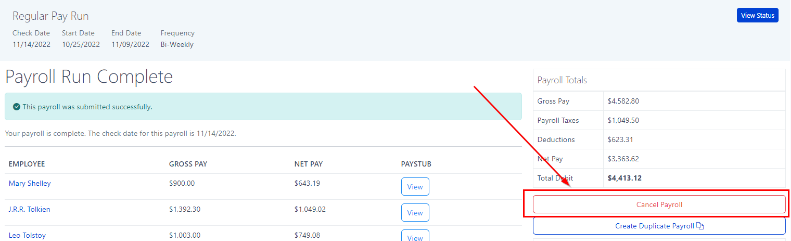

A. Is it prior to the 3pm deadline?

If it is prior the payroll's deadline then the client or the implementation rep can cancel the payroll.

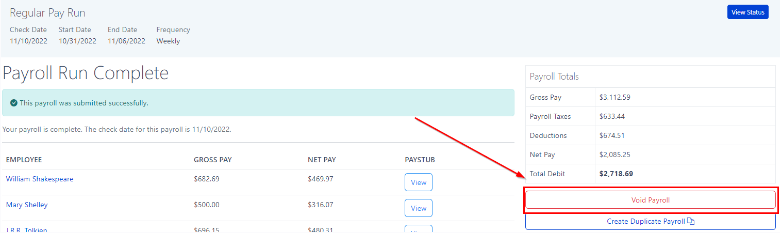

B. Is it after the 3pm deadline?

If it is after the 3pm deadline but BEFORE the check date, you can select the void payroll button.

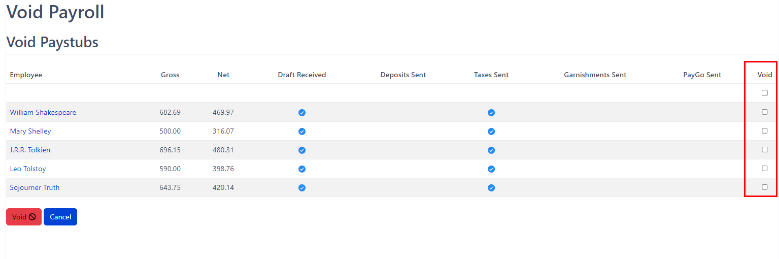

The next screen will allow you to void one paystub or multiple. After selecting the paystubs you wish the void, then click the red void button.

You will land on the Void Payroll Summary screen. This screen will provide an overview of the totals and a breakdown of each check you have voided.

Re-Issuing

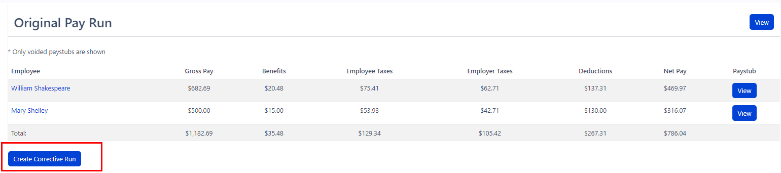

Since this was done prior to the check date, the direct deposits will not be sent for the selected employees. If you were only needing to stop the payment you can exit this screen.

If you need to reissue a new check since there was an error on payroll, you can select the create corrective run

This button will bring you to an enter payroll screen to re-enter the payroll data for that particular employee. Payroll processing with continue like normal. Note, CertiPay Online does not allow for next day check dates. Therefore, the employee will need to be paid via direct deposit at a later date OR paid with a paper check on site from the client.

Day of / After Check Date

The steps above walk through processing a void and reissue. The difference between after or day of check date, is that the employee was already paid. Therefore, when reissuing the check, ensure what the goal of the situation is. For example, did the client mistype hours and the employee is owed money or did they use the incorrect deduction through payroll.

If they employee does not need to be paid, then make sure to send the re-issued payroll to paper checks.

If the employee is now owed money, you can enter an After Tax deduction to payroll of the net pay of the voided payroll and the application can pay the remainder fees through DD or paper check.

Void Credits

Once the void is processed, the ticket will need to be escalated to the Funding Team to issue void credits to the client. This will only be needed if it is current quarter AND the client has remaining check dates in the current quarter. Void credits are not processed once a quarter is closed as Taxes will provide an update on how the client will be given tax funds back.

Direct deposits will be credited if it is prior to the client's check date and before the credit file is processed for the payroll's check date.

PayGo will be credited if the funds are not sent to the carrier. Monthly files are sent to carriers in arrears. If a client is questioning a credit for PayGo after the funds have been sent, than the client will need to work with the carriers on receiving the credit or wait until they enter their yearly audit.